Getting to Know Women Investors

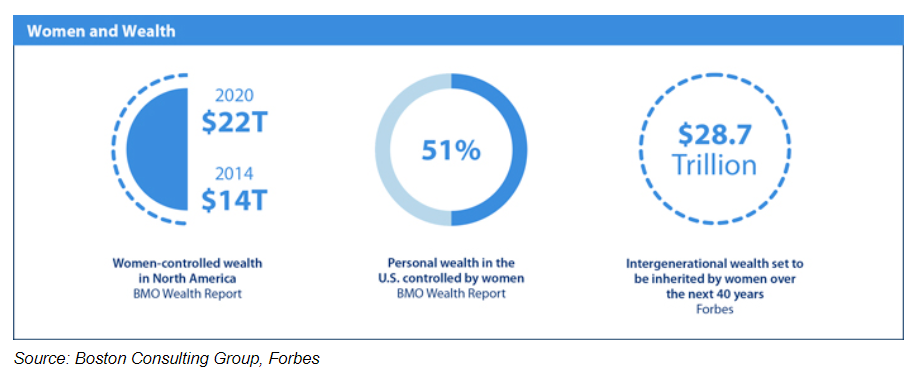

Women's economic clout is on the rise. They are generating and managing a growing amount of global wealth. They are increasingly participating in the workforce, leading major corporations, starting new businesses, and inheriting wealth. These positive shifts have translated into real financial power—and likely into a growing segment of your business.

But truly getting to know women investors will require you to understand (and then meet) their specific needs. Here, we’ll discuss a few key traits that have been uncovered regarding women investors that will provide you with valuable insights into this key demographic.

Make It Personal

According to recent estimates, women will control nearly $22 trillion in personal wealth by 2020, and they are expected to inherit $28.7 trillion in intergenerational wealth in the next 40 years (see chart below). But did you know that women who inherit wealth from their spouses or families are more likely to switch advisors if the current advisor did not invest in building a personal connection with them in the preceding years? Making it personal matters.

To understand why women may not feel personally connected to their advisors, it may help to think about some general categories of women investors. New York Life Investments recently conducted a survey of 800 U.S. women and identified four distinct subsegments with the following characteristics:

“Suddenly single”: Defined as women who have been separated, divorced, or widowed in the past five years, 32 percent of the suddenly single group feel patronized by financial advisors. Further, 51 percent said they may not work with an advisor again.

“Married breadwinner”: These professional women represent the primary source of income for the household, with 44 percent feeling that financial advisors treat women differently than they do men.

“Married contributor”: In this group are professional and nonprofessional women whose primary contributions to the household tend to be nonfinancial. Here, 32 percent feel unconsciously excluded in conversations with advisors.

“Single breadwinner”: This segment includes professional and nonprofessional women who live alone or as a single-family unit. Of these women, 27 percent would like greater financial education.

It seems the financial services industry has come up short in its efforts to build connections with women investors. But to make strides, advisors need to capture women’s hearts and minds, plus have a heightened awareness of unconscious biases that may be at work.

Build Trust Through Communication

One of the best ways to establish a personal connection is through effective communication. Women want their investing ideas to be taken seriously. At the same time, some feel their lack of financial education is an obstacle to investing. Many women will certainly value your knowledge, but they would also like to develop confidence in their own abilities.

So, how can you develop a relationship in which your female clients feel understood, empowered, and respected? Talk to them—not down to them. Keep in mind that women generally opt for face-to-face meetings, are very aware of body language, and prefer accessible language over financial jargon. Finally, if given the option, many women will choose to attend in-person educational events rather than an online class or a social media group.

Welcome Women to the Investing Table

It has been said that compared with men, women have fewer assets, do not like to take risks, are not interested in investing, and are not as critical to decision-making. But we know that women control a substantial amount of wealth. Women also make most, if not all, consumer purchasing decisions. They generally tend to ask more questions and may be more cautious than men. This approach does not necessarily mean they are more risk averse than their male peers. Rather, it reflects their awareness of the financial—and emotional—risks involved with investing.

Just as with many other aspects of their lives, women are often trying to find the right balance between risk and return. Perhaps riskier investments fall outside of their comfort zone. If so, you can play a critical role by focusing on the risks that matter and connecting that information with their goals to influence productive investment behavior.

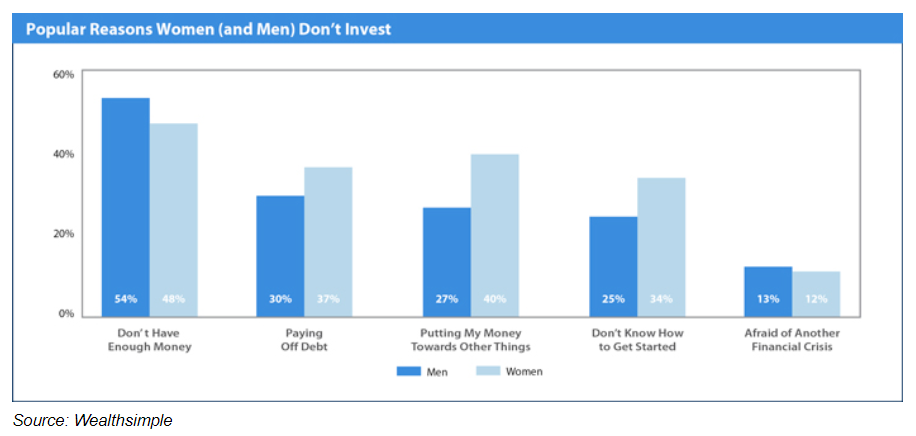

Women, in general, do tend to invest less than men. But it’s not because they are averse to investing or to risk-taking. A Wealthsimple survey of a sample of Canadian college graduates between the ages of 30 and 35 found that one-third of the women surveyed reported not knowing how to get started with investing (see chart below). Plus, the infamous pay gap between men and women leaves women with relatively fewer assets to invest versus their male counterparts. With this in mind, education and outreach are key to bringing this huge client base to the investing table.

Seize the Opportunity

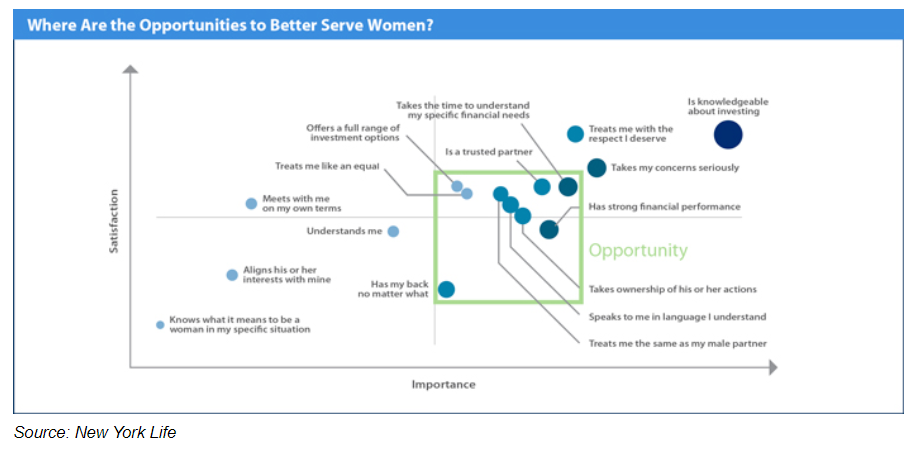

Generally speaking, women investors do not focus solely on beating the benchmark. Consequently, they are often less inclined to change financial advisors based on poor performance alone. Women’s decision-making tends to be values-based and intrinsically linked to their financial goals and priorities. Women may take longer to make decisions and define skill as understanding the market and the risks. They are apt to consider different aspects and views before making a decision and trade less. Even when they trust an advisor with their money, women investors still want to feel like they’re in control. As such, they look for advisors who are aligned with these values and who are personally invested in their success.

To make inroads with this demographic, be aware that women are likely to place a high value on your interpersonal skills. They want to feel connected, to know that their voices are being heard, and to ensure that their needs and concerns are being addressed. Cookie-cutter solutions won’t work! But advice on holistic financial well-being that is specific to their unique needs just might. In an ever-changing environment where many are feeling increased pressure from robo-advisors, the desire for a more personalized touch is certainly good news.

The chart below highlights areas that women rank high in importance but low in satisfaction. If addressed appropriately, they could present opportunities for financial advisors to better serve women.

One Size Does Not Fit All

Of course, women are not a one-size-fits-all market niche or segment that can be addressed with a single playbook. They have had multidimensional journeys and hold unique financial priorities and values. But there are subsets of women investors with relatively common issues that, if addressed appropriately, can help you differentiate yourself and scale up.

To successfully leverage this relatively untapped opportunity set, you must look past generalizations about “women’s issues.” With consistency, diligence, and respect, you can evolve your practice to meet the needs of what will increasingly become a female-dominated client base. Remember, women tend to be sticky clients. So once won over, they will be with you for the long haul.

This material is for educational purposes only and is not intended to provide specific advice.

Please review our Terms of Use.