Do You Need a CPWA Certification to Serve HNW Clients?

Are you a wealth advisor looking to enter or expand your reach in the high-net-worth (HNW) market? This client segment includes business owners, executives, creative professionals, and next-gen heirs with a net worth of $5 million or more.

These potential clients represent a diverse group with unique challenges and life goals far beyond asset accumulation. To attract and retain HNW clients, you’ll need advanced technical expertise and nuanced skills in people and family dynamics management.

How can you get or fine-tune these skills? Earning the Certified Private Wealth Advisor® (CPWA®) certification from the Investments & Wealth Institute (IWI) is one way to accomplish this goal. But is it worth the time, effort, and money you’ll dedicate to the process?

To help you make your decision, let’s review what getting a CPWA certification involves and how it could benefit wealth advisors who wish to serve HNW clients.

What Is a CPWA Certification?

The CPWA certification program involves a unique, multidisciplinary approach to addressing the financial needs of HNW clients. Applicants to the program can choose between two enrollment options:

A 6-month online program including a 1-week, in-person class at a top business school

A 12-month online-only program

The prerequisites are:

5 years of financial industry experience

BA or at least one advanced industry certification

Background check

Lastly, you must pass a four-hour final exam covering 135 questions.

What Are the Top Reasons to Consider the CPWA?

The primary benefits cited by many advisors holding this certification are:

Competitive differentiation in the crowded HNW market

More confidence in working with ultrawealthy clients

Advanced knowledge specific to solving complex planning challenges

Potential for higher compensation and career advancement

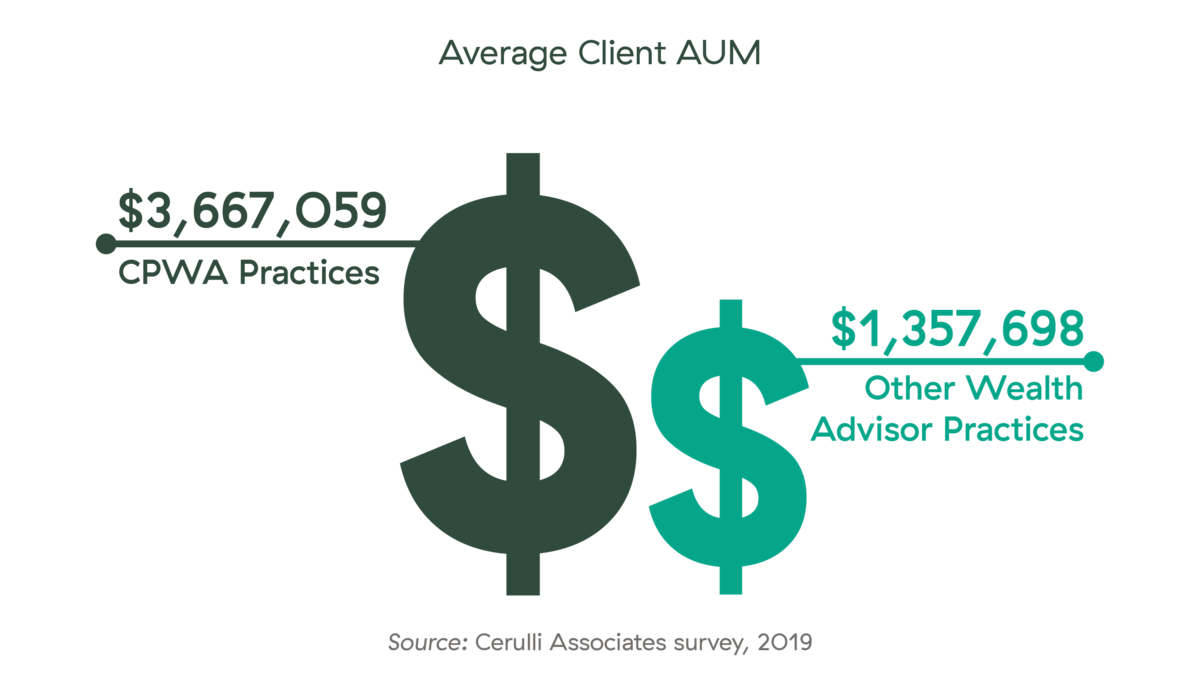

And, recent data tells us that a CPWA certification may be an effective way to grow your practice. According to Cerulli Associates, CPWA practices have the largest average client size in the industry:

What Will You Learn?

The CPWA program’s curriculum is designed to give you the theory and practical techniques you’ll need to serve HNW clients—and to pass the required certification exam. The 11 core topics are broken down into the following 4 categories:

1. Wealth management. Understanding the big picture is essential to optimizing planning for the ultrawealthy. This segment will help you analyze and recommend tax-efficient solutions and learn how to build and manage portfolios that meet complex HNW goals.

Tax planning. This deep dive into HNW-specific taxation will guide you in talking about strategies with clients, simplify planning, and help you work effectively with clients’ tax attorneys.

Portfolio management. This segment will elevate your abilities to harmonize wealth-building techniques, risk management, tax awareness, and portfolio strategies with clients’ resources and goals.

Risk management and asset protection. You’ll learn to evaluate appropriate insurance and asset strategies to protect clients through life events including marriage, divorce, and death.

The [CPWA program] content was fantastic and significantly increased my ability to add value to my target market ($1 million–$5 million investable, primarily corporate VP-level people).”

2. Human dynamics. Working with any client segment requires strong skills in managing expectations, decision-making, and relationships, but you’ll need to raise your game when serving the highly affluent.

Ethics. Learning to identify and classify ethical and regulatory issues across the wealth management spectrum will allow you to work confidently with a sophisticated client base.

Behavioral finance. Cognitive and emotional biases can interfere with a client’s ability to make sound decisions. By learning how to identify biases, you’ll be better equipped to correct or complement these tendencies.

Family dynamics. Tailoring strategies for family organizations, trusts, and business entities will depend upon your understanding of key family roles, family office infrastructures, and the nuances of performing client discovery.

3. Legacy issues. If you haven’t mastered the complexities of how charitable and estate planning solutions help clients transfer wealth, this segment will give you the advanced skills you need.

Charitable giving and endowments. You’ll learn to assess the advantages and disadvantages of public and private charities, foundations, and trusts, as well as the tax implications of giving strategies in complex client scenarios.

Estate trusts and wealth transfer. Although parts of estate planning may lie outside your responsibilities, a full understanding of wealth transfer, end-of-life planning, and fiduciary issues is essential to the work of an HNW wealth advisor.

4. Specialty client services. There are specific challenges involved with business planning in conjunction with HNW clients’ broader planning and portfolio management needs.

Executive compensation. This segment addresses how to evaluate stock options, deferred and equity compensation plans, and concentrated stock situations, including rules, restrictions, and tax implications.

Closely held businesses. As a significant population of the $5 million-plus client base, closely held business owners need advisors who can make appropriate recommendations about business entity structures and their tax implications, buy-sell agreements, valuation methods, the business lifecycle, and succession planning.

Retirement. To guide clients with vast assets through the distribution phase, you’ll need to understand return sequencing, analytical forecasting, tax treatments, Roth conversions, distribution requirements, and evaluation of qualified plans and net unrealized appreciation (NUA) rules.

So, Is the CPWA Certification a Worthwhile Investment?

If your business goal is to attract and retain HNW clients, the knowledge and insights offered by a CPWA certification may help you target—and better serve—this corner of the advisory market. But, be sure you have a clear plan before diving in. Making lasting connections with your desired clientele always depends on your firm’s service offerings and the client experience you deliver.

FREE DOWNLOAD

Advanced Financial Planning Strategies for High-Net-Worth Clients

Explore creative, comprehensive financial planning solutions—from asset protection to charitable giving—for your high-net-worth clients' unique needs.

Commonwealth and IWI are separate and unaffiliated entities. Please consult your member firm’s policies and obtain prior approval for any designation/certification programs.

This material is for educational purposes only and is not intended to provide specific advice.

Please review our Terms of Use.