Guiding Women Through Financial Change After a Divorce

The COVID-19 pandemic has had a surprising effect on divorce rates in the U.S. Health and economic concerns as well as other uncertainties have prompted some unhappy couples to try to stick it out, and divorce rates have actually declined. As more people get vaccinated and gradually return to pre-pandemic routines though, the numbers are likely to surge. And if you’re an advisor guiding women through financial change after a divorce, this anticipated uptick is something to think about.

Divorce is one more area where we’re seeing evidence of the pandemic’s impact on women. Women tend to be hit harder financially after divorce to begin with. And because women have experienced the highest rates of job losses in 2020, a post-pandemic divorce is even more likely to interrupt a woman’s financial path. The impact may be most acute for clients who find themselves in a “gray” or late-life divorce. Gray divorce rates were already outpacing those for younger couples before the pandemic. The decision to end a marriage after age 50 could mean unraveling assets and finances that have been shared for decades.

With this in mind, as an advisor guiding women through financial change after a divorce, what should your conversations include? There are several areas you can focus on to shed some light—particularly for clients who ceded control of major financial decisions to their spouse—including helping them understand the division of marital assets, income considerations, and estate planning.

Division of Marital Assets

This topic can become highly complicated. Assets acquired during marriage are split according to state law. Most states follow equitable distribution rules that will consider all marital assets, and a court will determine their distribution between spouses. In the nine states that have community property laws, assets acquired during marriage are considered owned 50 percent by each spouse, with certain exceptions. Similarly, debts acquired during the marriage are generally attributable to both spouses. In noncommunity property states, debts usually stay with the spouse who incurred the debt, unless the other spouse cosigned or otherwise guaranteed it.

Retirement savings. Contributions to employer-sponsored retirement plans and IRAs made during marriage are generally considered marital property, with some exceptions. Contributions made outside of the marriage can be considered separate property. Qualified plans, such as pensions or 401(k)s, should be divided pursuant to a qualified domestic relations order (QDRO). A QDRO allows for a tax- and penalty-free transfer to a nonowner ex-spouse. Neither the original owner nor the divorcing nonowner should be taxed or penalized if the nonowner rolls the assets directly into a qualified plan or an IRA. If the nonowner spouse receiving the distribution uses the funds in any other fashion, a tax will be imposed on that distribution—but only to that spouse.

Early discussion of the QDRO can be helpful to the nonowner spouse, as options can vary from plan to plan. Pensions, for example, will generally not pay a lump sum but will make payments to the ex-spouse the same way they would be made to the employee-owner. The sooner a QDRO is presented to a plan administrator, the clearer the understanding a divorcing spouse will have over her options.

The discussion about your client’s options should also include creditor protection. As retirement plans covered by ERISA, 401(k) plans have creditor protection. If the 401(k) is rolled into an IRA, it will continue to be protected from bankruptcy creditors, but it will only receive general creditor protection as provided by state law.

Dividing an IRA is different. ERISA does not cover IRAs, and the division of an IRA does not require a QDRO. For federal tax purposes, if the division follows a court-issued divorce decree and is made as a trustee-to-trustee transfer as opposed to an outright distribution, an IRA owner can avoid tax and penalties. Once the asset is transferred, each spouse becomes solely responsible for tax and penalties of any future distributions.

Family home. If one spouse wants to hold on to the home, the marital estate can be equalized from other assets if necessary. Current circumstances related to the pandemic may complicate the equalization, though. Because inventories and interest rates remain low, demand exceeds the supply of homes for sale. In this seller’s market, we’re seeing homes sold immediately after the Coming Soon sign is posted. Plus, the rise in values across the U.S. increases the likelihood that the equalization may involve the exchange of additional liquid assets to keep the house.

You will have to factor in ongoing mortgage payments, property taxes, and maintenance expenses into your client’s current cash flow and long-term financial plan to see whether keeping the home is actually feasible. If not, it may be time to look into alternatives—like refinancing or downsizing.

Life insurance. The accumulated cash value of a life insurance policy is subject to division—much like any other marital asset. Transferring a policy’s ownership can be part of a divorce decree if it’s necessary to divide the cash value. If your client owns a policy, though, be sure she changes her beneficiary designations if she doesn’t want her ex-spouse to receive the death benefit.

Income Considerations

In the division of marital assets, income may need to be equalized if one spouse was the breadwinner. State family laws determine any alimony amounts. Whether your client will be paying or receiving alimony payments, the impact on her monthly or annual cash flow should be factored into the financial plan.

Alimony. Under the Tax Cuts and Jobs Act of 2017, alimony payments are no longer deductible by the payer, and consequently, the payee can’t include the money as taxable income. This change applies to divorce settlements made after December 31, 2018. It can also apply to existing agreements that are modified after that date but only if the modification explicitly states that the new rule applies.

Social security. Your divorced client may be able to collect social security income on her ex-spouse’s working record (even if the ex-spouse has remarried) as long as she has not remarried, the marriage lasted more than 10 years, and the couple has been divorced for more than two years. She and the former spouse must be 62 or older for her to qualify. If she was born before December 31, 1953, she can file a restricted application allowing her to receive up to 50 percent of her ex-spouse’s full retirement age benefit amount, while her own benefit can grow with delayed retirement credits. If she’s hesitant to explore this option, you can reassure her that her ex-spouse won’t be aware of her claim and does not need to be involved.

Children’s social security benefits may be available for an unmarried ex-spouse of any age who is caring for a child younger than 16.

Child support. Child support issues, including financial support and physical care, are a highly sensitive matter usually resolved in court. The divorce decree should specify the amounts, if any, of child support paid from one spouse to the other, as well as who will be entitled to claim the children as dependents for tax purposes. While the pandemic’s impact on women has been largely disproportionate, one positive outgrowth is a growing consensus that childcare is, in fact, infrastructure. This focus may ease the childcare burden for women who are custodial parents.

Estate Planning

To accommodate any adjustments following a divorce, encourage your client to update her estate plan. Although most state laws nullify a beneficiary or fiduciary designation of an ex-spouse, she may need to amend or get new trusts, wills, and powers of attorney, as well as change beneficiary designations. If the former spouse was named as her trusted person or beneficiary in documents or on accounts, these designations should be changed as soon as possible. And if your client retains custody, even partial custody, the guardianship of the minor—both the child and the child’s estate—should be addressed in her estate planning documents.

Taking the Long-Term View

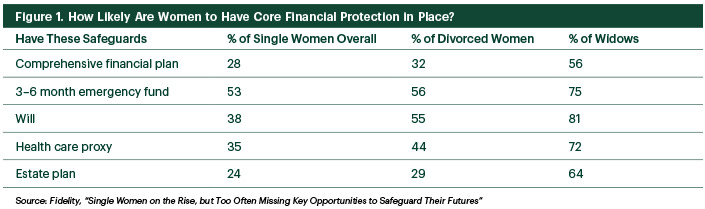

There is a burning need for long-term planning when guiding women through financial challenges after a divorce. Many married women lack a comprehensive view of their finances. In a 2017 Fidelity Investments survey, only about one-third of divorcées felt financially prepared for the breakup of their marriage (see the chart below).

In addition to encouraging estate planning, emergency savings, and health care plans, an advanced strategy should ensure protection against a loss of income with adequate insurance for health, life, and disability. Disability insurance can provide necessary income replacement when a single woman has no partner to step in, and a single woman with children can use life insurance to protect the needs of those under her care after her death.

Commonwealth Financial Network® does not provide legal or tax advice. You should consult a legal or tax professional regarding your individual situation.

Editor's Note: This post was originally published in October 2019, but we've updated it to bring you more relevant and timely information.

This material is for educational purposes only and is not intended to provide specific advice.

Please review our Terms of Use.